Timberland Investments – Thoughts and Discussion

Timberland Investments – Thoughts and Discussion

Advantages of Investing in Timberland

(click on a topic to go to that section of the page)

- Timberland is a hard, tangible asset.

- Historically, timberland has provided excellent long-term investment returns.

- Timberland investments can provide both annual and periodic revenues.

- This investment has lower risk due to low price volatility and a high correlation with inflation (great inflation hedge).

- Timberland returns are uncorrelated with stock portfolio returns and thus provide portfolio diversification.

- Investments in timberland provide returns through price appreciation.

- Timberland provides returns through biological wood growth.

- Owners of timberland can enjoy recreational activities on the land.

- Timberland grows a renewable natural resource.

- Timberland sequesters and stores carbon from the atmosphere.

- Investment in timberland is accessible to investors of all classes – from individuals to institutional and corporate investors.

All man-made investments, buildings or roads or what-have-you, begin to deteriorate the moment they are completed. Timberland is new and better every day that we leave it to grow than it was the day before.

I’ve spent the majority of the last 30 years buying, selling, and managing timberland. There is no investment quite like it, as I hope you’ll soon see.

If you’re reading this, I am guessing that you are at least a potential investor. You understand investment performance and risk issues. You probably own stocks, bonds, mutual funds, EFT’s, etc. either in a personal investment account(s) or in your retirement account (401k, IRA, etc.). Or both. If you are considering a land investment, particularly a timberland investment, you will want more than a surface glance at the pros and cons.

Follow the links above to discussions about these advantages of investing in timberland. As a potential investor, any or all of these attributes may appeal to you. Hopefully, at least a few do so.

So, this post, like timberland investing, is a long game. I’m looking forward to exploring these topics with you.

BH

Timberland is A Hard Asset and Inflation Hedge

I’ve been in the timberland investments business for 30 years. I’ve never seen the value of a timberland investment go to zero, not even close, and I never will. That’s one of my favorite attributes of the asset class.

Timberland is a hard asset. Like gold, silver, commercial real estate, and many other hard assets, timberland lasts as a means of growing and protecting wealth. This is true even in bad economic times. There won’t be a significant new supply of land suitable for growing timber (as we have in Alabama and Georgia, where I currently operate) appearing any time soon. It is a precious asset in limited supply. Timberland also continues to provide revenues to its owners during a downturn.

In fact, the worst of economic times, at least in my lifetime, has just occurred with the Great Recession. During the collapse of the stock market in 2008/2009, equities suffered losses in the range of 40%. Many stocks became worthless or became worth mere fractions of their former values.

Timberland Investments hold value even in hard times

Timberland fared much better during that time. Here in the Southeast, we did see a definite softening of values of timber and timberland, but there was never any fear of losses that we saw in many equity segments.

Further, most timberland owners were not required to cash out their positions during the recession and were able to wait out the downturn. Yes, there have been a number of institutional and other investors who, by the nature of their investment vehicles (10-year closed-end funds, for example), have had to sell assets at less-than-advantageous points in time. I know of several here in Alabama and Georgia who have been through that. But, for those who have kept the faith and have been able to wait for prices to rebound, it is turning out fine.

Timberland Investments as a hard asset – takeaways

So, for this one chunk of our discussion on the advantages of timberland, the important takeaways are that:

- Like virtually all hard asset classes, timberland will maintain most of its value through economic downturns. Its value will not go to zero. Also, timberland will always maintain usefulness as a generator of revenue.

- Timberland has an almost unlimited shelf-life. It’s not going anywhere.

There are many other aspects of timberland investments to discuss. Keep an eye on this post for further exploration of the subject.

Timberland Investments – Do They Make Good Financial Sense?

We know this…all of the non-financial benefits of owning land (recreation, sporting, etc.) are great.

But, unless this investment helps move you toward your plans for retirement, your children’s education, or other financial goals, it becomes a cost-center. A luxury. Maybe even a millstone around your neck.

So, what kind of returns do timberland investments bring?

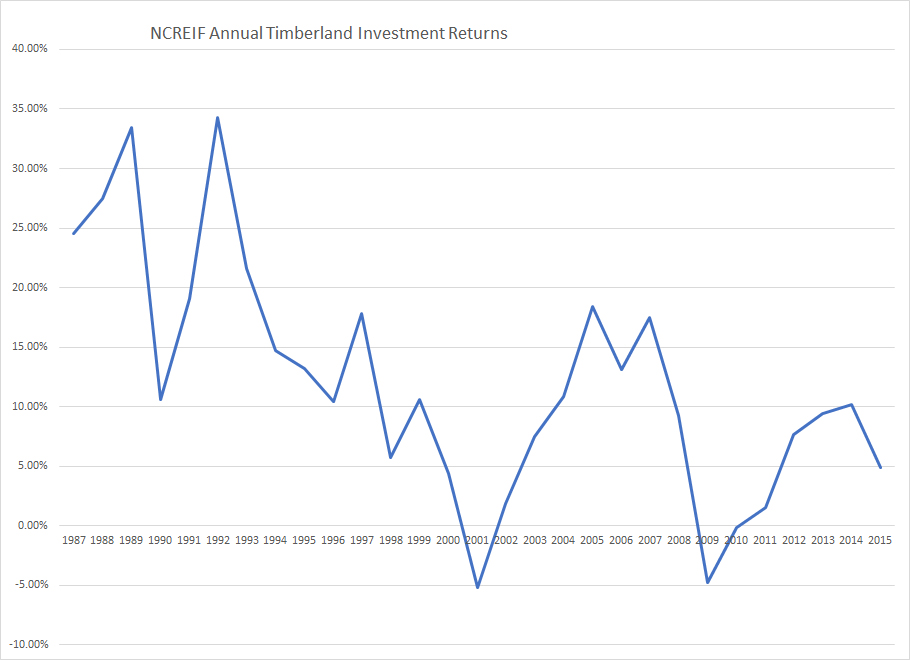

The quick and dirty answer is that, according to one widely-accepted measure, timberland assets nationwide return about 12% per year to investors. I’ll explain below where we get that number. I’ll also explain some of the recent history around the investment world’s view of timberland.

Caveat: I operate in the Southeastern U.S. (Alabama, Georgia and surrounding states), and I believe that 12% is probably a bit high for my region. My gut tells me that 6% to 9% overall is probably more like it.

From experience, I know that land investments have helped and are still helping individuals, families and other investors reach and, in many cases, exceed their needs and/or goals for growing wealth, for income, and for security.

Some History of Timberland Ownership in the U.S.

The most widely-accepted measurement in the investment world of returns from timberland is published by the National Center for Real Estate Investment Fiduciaries (NCREIF). They began their index for timberland returns in the 1980’s, because something big happened in timberland investing during that decade.

Prior to the 1980’s, large paper companies and lumber companies (International Paper, Weyerheauser, Champion International, and many others) owned vast amounts of the privately-held timberland in the United States. The companies had acquired and held all of that land and the timber on it in order to ensure they would have an ample supply of raw materials for their manufacturing operations.

The mindset at the forest products manufacturers was “We must own the land to ensure that we’ll be able to operate.”

When I first started in the business in the late 1980’s, I was on a team that was trying to purchase several very large tracts of hardwood timberland spread across four Louisiana parishes along the Mississippi. The tracts were in the name Fisher Body Company.

The Fisher name did not click with me at first. Eventually, it dawned on me: Fisher Body Company. Body By Fisher. “Body by Fisher” was the inscription on that chrome plate that used to sit on the bottom door sill of every General Motors automobile, including my parents’ Oldsmobiles. Fisher Body was a division of GM responsible for car bodies, until GM dissolved it in 1984.

Fisher Body had purchased all of that timberland sometime in the early 1900’s to ensure that the company would have enough hardwood lumber from which to build car bodies! Steel (and now, aluminum and composite materials) car bodies hadn’t even been considered at that point.

The business of timberland ownership is filled with stories like this. Timberland has touched so many areas of life in the U.S.

1980’s and After – Forest Products Companies Divest Timberland

During the 1980’s, large paper and lumber companies began to realize that, while they would always need the timber from these millions of acres that they owned in order to supply their operations with raw materials, they did not necessarily need to actually own the land. After all, in their view, they were manufacturing companies, first and foremost.

If the companies could monetize – a fancy word for ‘sell’ – the land and timber by selling it to other investors who wanted to be landowners, they could use that money to enhance their manufacturing operations (many of which were beginning to go global). They could still reap the supply of timber from the land by simply buying the timber from the new owners. Often, sales of timberland included agreements toward that end, whereby the manufacturer guaranteed to buy the timber at some agreed-upon price. This is commonly referred to as a wood supply agreement.

Pension Funds and Endowments Enter the Timberland Business

So, the big paper and building materials folks are going to sell all of this land. Who’s going to buy it? Who has that much money? Billions of dollars?

Well, the list is pretty short, isn’t it? Fortunately, there was one class of investor with the money and the appetite for this type of investment: pension funds and endowments. For many of the reasons we’re going through in this series on timberland investment, this was and still is an attractive place for many of these entities to place their money.

Timberland is, for these entities, still a relatively small slice in their investment pies. But, these groups do favor some exposure to non-traditional or “alternative” investments as a part of their approach.

The need of the paper and building materials companies and the needs/wants of these large investment entities began to meet in the 1980’s.

So, that gets us back to NCREIF’s timberland index that began in 1987. Up until that time, there was no need for a timberland investment return index. But, once really big and sophisticated investment groups like pension funds and endowments entered the scene, things changed. They and other interested investors needed more sophisticated measures of timberland investment returns. NCREIF stepped in.

Not Like the Dow Jones, S&P or NASDAQ

There are a couple of considerations we need to keep in mind when thinking about the NCREIF timberland index.

First, the information used for the index is a sample and comes from huge, institutional and/or industrial owners. It does not include information from smaller to medium-acreage timberland owners. There are plenty of good reasons for this, but it’s mostly because smaller and medium-acreage owners don’t have economic activity on their timberlands every year, for the most part (except for some tax expenses and maybe some hunting lease income, etc.). The big guys and gals are always buying and selling and appraising timber and timberland in their accounts, because they have to do so and because they are dealing with such large blocks of ownership (tens of thousands of acres).

Another consideration is that, while the NCREIF sample size for national timberland returns is probably large enough (it’s pretty much all we have to go on, so it better be!), once you break it down into regions (Pacific Northwest, Midwest, Southeast, etc.), the sample sizes also are smaller by a bit. So, while the 12% number mentioned above is likely a pretty good national number, we may not have available to us a really great measure of returns on a regional or state level.

Timberland Investing is a Long Game

My message to potential timberland investors is this: This is a LONG game. Timberland may be the longest-term investment that most of us will ever make or contemplate. My sons, not I, will harvest the trees that I planted in the last few years. The value of the land and the timber on it will rise and fall with the seasons and the years. That’s okay. We don’t invest in timberland to make a quick buck. We do so, because timber and land are scarce resources that will increase in value over the long term and, for the intervening period, will never lose all of its value. Also, we do so, because trees grow – every year.

Above is a chart of the year-by-year returns that NCREIF reported, through 2015. It’s not a horizontal line. And, yes, the returns toward the end of the chart look bad. Answers: 2001 – Tech collapse; 2008/9 – Banking and housing crises.

It’ll come back. Personally, I see the right hand side of this chart as suggesting it’s a good time to buy.

I may be prompting more questions with this post than I answer. I hope so. Stay tuned. More to come.

Timberland Provides Income to Its Owners

Timber Growth is the Primary Source of Income for Timberland Owners

The most significant source of income for timberland owners is the growth of the trees. While the actual realization of that income comes only when you harvest the timber, that’s not the important part of the story. Timber, your inventory of trees, grows at an annual compounded rate of some 3% to 5%. That is the great truth of being a timberland investor. The trees are working for you, year after year. And, you really don’t have to do much, while that takes place.

Again, the realization of timber income comes when the trees are harvested. We will explore how this happens with a later post, but just know for now that the timing and methods of timber harvests are crucial, absolutely crucial, to your success as a timberland investor. If you and your logging contractor do it right, your returns on your investment can be greatly enhanced. If you don’t, you can very quickly and easily get stung. And, you can’t go back and put the trees back on the stump afterward.

Hunting Leases – A Key Source of Income

The other important source of income for timberland investors is annual recreational leases, aka hunting leases. Sportsmen across the nation line up for the chance to obtain an annual lease on hunting land, where they can spend their recreational time preparing for the hunt, actually hunting and then reliving the hunt with their family and friends. It is, for them, a wonderful diversion and social activity.

I’ve managed literally hundreds of hunting leases over the last thirty years. I strongly believe in leasing land to hunting clubs for a couple of reasons.

Benefits of Hunting Clubs

First, of course, is the income the leases provide. The price per acre varies greatly, but let’s say there’s an average out there of some $10 per acre per year. That amount will, in most places, cover your property taxes for the year and then some.

Second, hunting clubs are very beneficial to the management of your property. They tend to build and maintain roads, which allow you to more easily tour your property periodically. The clubs also can act as a sort of early warning system for you, as long as you maintain good communication with them. This can be especially helpful in prompt detection of pine beetle activity, which can damage large areas of timber if left unaddressed. Beaver activity is another threat the clubs can help you watch for.

The last significant source of income for timberland investors is government cost-share programs, whereby a governmental body assists in some management activity that you undertake on your property. This is a topic we’ll cover in a later post. Personally, I see these programs as a sort of one-off. I don’t consider them when I think about returns on timberland investment. I see them more as a means of reaching a specific management goal, such as planting hardwoods in wet areas or planting some other wildlife-beneficial trees, etc. on the property.

Income Basics – Conclusions

So, timberland does provide a very nice income for its owners, if the owners manage it properly. That’s a good thing. There probably would not be many acres of privately-owned timberland in the United States, if that were not the case. The owners of the the land would put it to some other productive use otherwise, without a doubt.

Timberland Investments – Risk Considerations

Timberland is Seen by the Investment Community as Carrying Less Risk than Equity Investments and an Inflation Hedge

This is a more difficult post to put together than my previous posts, mainly because there’s really not a huge amount of information/data available on the relative price risk of timberland investments vs. equity investments. Further, no discussion of investment risk of any kind is going to be all that exciting. But, it’s important. So…

From a price or market value perspective, there are two components that work together to put timberland on a favorable risk footing vs. traditional investments: lower price volatility and correlation to inflation.

Timberland’s Price Volatility is Low

We again go back to the NCREIF timberland price index. Imperfect though it may be, it is by far the best source of information that we have on historical timberland prices. According to the index, timberland’s price volatility over the last thirty years or so has been less than half that of traditional equity investments. It is said that, with respect to price volatility, timberland behaves much like a 10-year treasury bond. It just doesn’t have the wild ups and downs that you might see with stocks, etc.

Why is THAT so? I believe a big part of it is the relative lack of liquidity in timberland investments. You can’t just call your broker and tell him to get you out of timberland for today and then jump back in tomorrow. There are some timberland-related securities, such as REITs (a topic we’ll hopefully hit later on), where you CAN jump in and out, but even with those vehicles, the underlying asset – the timberland owned by the REIT – is not very liquid. So, the chances of wild ups and downs on a daily, weekly or even monthly basis are pretty low. Just my opinion, though. Someone may set me straight on that.

Timberland Tracks Inflation Closely

The other component of this whole relative risk thing is timberland’s high correlation to inflation. Timberland prices have tended to track inflation very closely over the period that the NCREIF covers. It is a great inflation hedge. ‘Not a shock. Timberland is a hard asset with the commodity aspect of the timber that’s growing on it. In general, if lumber prices go up, timber values go up.

The relationship is not a perfect one-to-one, but it’s close enough that we can say that timberland SHOULD pretty closely track inflation. At least that’s so if lumber prices move with overall inflation, as they have for most of the NCREIF’s history. The housing crash put that relationship to the test, for sure. But, generally, lumber should move with overall inflation, as long as lumber is used for home construction.

So, anyway, a strong argument for timberland as a low-risk investment can certainly be made.

And, so, consider this…

Risk Considerations – Conclusion: Great Investment

Timberland has provided returns of somewhere in the 6% to 9% range, over the NCREIF period. That compares favorably with the S&P, etc. With less risk and comparable returns, would it not seem that timberland can be considered an excellent investment?

Now, this section of the discussion is all about timberland’s PRICE risk. There are other risks to consider. I don’t like talking about THEM, of course, but we’ll cover them at some point. A quick list: physical (storm, fire, insects, disease); regulatory; local market disruptions; overall economic conditions. Maybe a few more. They are all important to keep in mind, but I don’t believe they should keep you from jumping in, if you are otherwise inclined to do so.

Timberland is an Asset Class that is Uncorrelated with Stocks

It almost goes without saying, but we’ll say it here. An asset class that closely tracks inflation and behaves much like a bond is, of course, an asset class that is uncorrelated with stocks. It’s not a perfectly inverse relationship, but it can be said that, when stock values are moving rapidly up or down, it’s unlikely that timberland values will move with them. In fact, as the factors that tend to drive stock prices (inflation, high volatility, etc.) come into play, they will not affect timberland prices in the same way.

The important take away from that is that timberland provides portfolio diversification against the vagaries of stock values. Diversification – that is what is important here. That’s what uncorrelated asset classes do for a portfolio made up of common stock. Timberland is no different.

Timberland Investments Provide Returns Through Price Appreciation

There are a handful of attributes of timberland investments that never cease to amaze me. Generally, they are observable not over the course of a few minutes, hours, days, weeks, months or even a few years. They are observable in blocks of, say, five years or more.

The most striking to me is something we’ll cover here in a few weeks: biological wood growth. Watching a pine plantation grow over a decade or two. Watching a naturally-regenerated hardwood stand grow and canopy-out. Again, that takes decades.

Another aspect of the investment that is both amazing to me and observable only over long periods of time is appreciation in the value of the underlying land component in a timberland investment. The dirt.

It sneaks up on you. When you work in the business day-in and day-out, you begin to get a feel for what dirt, timber, etc. is worth. You don’t think about it, the value of an acre of dirt, too much. You just know. You rock along with that number in your head, going about your business.

Then, one day, all of sudden, everything has changed! Yesterday, the value was X. Today, the value is 1.25(X)! 2(X)!

What happened? Did it really change overnight like that?

No, of course not. It’s been changing incrementally – so slowly that it’s hardly perceptible – all along. There may have even been periods (weeks, months, years, maybe a decade!) that the value has decreased. Ask any timberland investor about the Great Recession.

There have been ups and downs all along. But, through it all, the value of that acre of dirt has gradually increased. You just couldn’t see it. Until you could.

That’s how price appreciation works in timberland, at least in my experience. When I came to work in 1988, the effects of the S&L Crisis (remember that?!?) were still being felt in the land market. The value of dirt around Central Alabama, where I worked, was probably something on the order of $250/acre to $300/acre, on a good day. I worked for a long period with that number in my mind. Then, one day, all of a sudden, it was $500. Then, $700. Today, I work with something between $800 and $1,200 as my “dirt value.”

So, let’s say that in 1988 the value was $250/acre and now it’s $1,000. That’s a 400% increase in 30 years – all with a very safe investment and with very little price volatility. Not too shabby.

Like our pine plantation is growing wood so slowly that we don’t notice it, the underlying dirt in a timberland investment is going to grow value – little by little – over the years.

Timberland Provides Returns through Biological Wood Growth

Perhaps the one characteristic of timberland investments that investors find the most attractive is that, even while one isn’t harvesting timber, the trees continue to grow. While one eats, sleeps, recreates, works, or whatever, the timber is growing.

The growth rate of a pine plantation in the South is estimated to be around 3 to 4 tons of wood per year. With recent incremental improvements in seedlings and silvicultural/forestry practices, that figure may be higher.

In the south, foresters & landowners planting loblolly pine seedlings (the most common pine planted) usually put around 700-750 trees per acre in the ground (on a 6′ x 10′ spacing). Those trees will often be thinned once or twice before a final harvest takes place (around age 25-35 years).

So, for that periods of growth, the trees are adding volume each year and, each year, are growing into larger and more valuable timber products, such as sawlogs, veneer (peeler) logs and poles.

This growth feature is probably the one aspect of timberland investments that sets them apart from any other investment vehicle – certainly any one that I’m aware of.

Owners of Timberland Can Enjoy Recreational Activities on Their Land

Well, of course they can. Often, people purchase timberland mainly if not solely for the purposes of recreation. Many of us look forward to weekends on the farm or time in the woods with family friends. Try doing that with a CD, a mutual fund or some other investment portfolio.

Timberland Grows a Renewable Natural Resource

As a building material, a source of fiber for paper products, as a source of fuel, and as the raw materials for any number of products, timber is the most renewable resource on the planet, and it has always been so. In fact, the United States now has more standing timber than at any time since The Depression, and that volume continues to increase every year.

Why? Because, there are both economic and ethical reasons for private landowners to continue to grow timber. Whether by planting pine plantations (either on harvested timberland or by converting open ground to timber) or by managing for natural regeneration of hardwood and/or mixed pine-hardwood stands, keeping and putting land in timber continues to be a great choice for virtually any owner of private ag land – particularly in the United States.

Those landowners are making or continuing a great investment AND they are doing it in the GREENEST of ways.

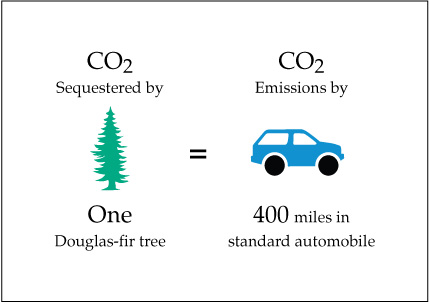

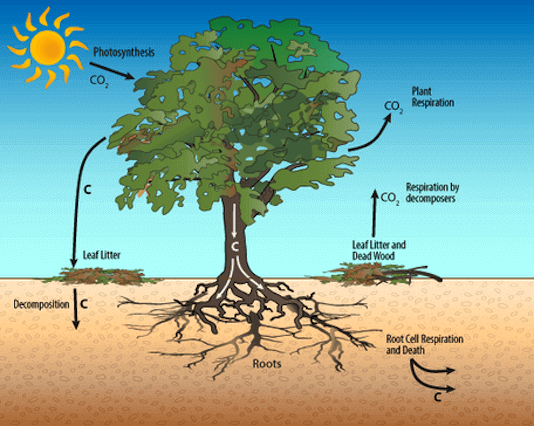

Timberland Sequesters and Stores Carbon from the Atmosphere

Timberland is a growing, dynamic carbon sink. Carbon from the atmosphere is stored in growing trees, and, to the extent that products made from those trees remain intact (furniture, flooring, paper, etc.), that carbon remains stored in those products and out of the atmosphere.

The CFA Institute has an excellent read on this. Click Here to go to their website.

While not yet fully developed, there are markets for sequestered carbon emerging around the world, and they will hopefully provide added economic incentives for sustainable forestry practices.

Timberland Investments are Accessible to All Investors

So, you don’t have a million bucks to drop on a timberland investment? Not many people do.

While timberland investments have become common components of the portfolios of large investment funds such as Harvard University’s endowment funds, the California Teachers Retirement System and other large institutional investors, timberland is also popular with investors of all classes.

Certainly, a purchase of a timberland investment outright (say, a couple of hundred acres of Alabama timberland growing planted pines) requires a fair amount of cash.

But, let’s say that you have some portion of your retirement savings or other funds that you would like to put into timber and timberland investments? One alternative would be to purchase shares in one or more publicly-traded Timberland REITs (timberland real estate investment trusts).

As of today, January 14, 2022, the primary publicly-traded Timberland REITs (along with their market caps and dividend yields) are:

| Company (Stock Symbol) | Market Cap | Dividend Yield |

|---|---|---|

| Weyerhaeuser (NYSE: WY) | $19.4 billion | 5.2% |

| Rayonier (NYSE: RYN) | $4.1 billion | 3.4% |

| PotlatchDeltic Corp (NYSE: PCH) | $2.6 billion | 4.1% |

| CatchMark Timber Trust (NYSE: CTT) | $484 million | 5.5% |

Those dividend yields are a lot higher than any savings rate you are likely to find, right now.

This type of investment also avoids the one real disadvantage to timberland investments (as I see it). Virtually all other timberland investments require a real estate transaction in order to invest and/or divest. Real estate transactions take time, from weeks (under the best circumstances) to months or even years. Investments in Timberland REITs are liquid. You can buy and sell them at any time.

So, if you have the ability to invest a portion of your retirement funds (if you have a self-directed account, for instance) or if you have other funds available to invest, you can become a timberland investor.

For a great read on investing in Timberland REITs, Click Here.

That’s it, for now. Email [email protected] with comments and/or questions. Be nice.

Hello, and thanks for visiting NatVest.com.

My name is Bucky Henson. I am Qualifying/Responsible Broker and President of NatVest LLC.

Among other things, I’ve worked with natural investment properties (timberland, farms & other real estate) for about 30 years.

NatVest.com is my blog directly intended to present the idea of landownership to people who haven’t previously considered land as an investment option and as a way of life. It is both.

We hope to present a wide array of perspectives of land ownership and stewardship that will, hopefully, spark interest and interaction about the topic.

We welcome you and, more so, welcome your input and participation in the discussion.

I can be reached at [email protected] or on my cell: 334-412-2487.

And, by the way, I am now taking listings for properties for sale in Alabama and Georgia, so please give me a call, if I can help you.

Finally, I also handle timber sales, buy standing timber and help people evaluate their options on timber sales. So call or write if I can help with any of your timber sales needs.

Hello, and thanks for visiting NatVest.com.

My name is Bucky Henson. I am Qualifying/Responsible Broker and President of NatVest LLC.

Among other things, I’ve worked with natural investment properties (timberland, farms & other real estate) for about 30 years.

NatVest.com is my blog directly intended to present the idea of landownership to people who haven’t previously considered land as an investment option and as a way of life. It is both.

We hope to present a wide array of perspectives of land ownership and stewardship that will, hopefully, spark interest and interaction about the topic.

We welcome you and, more so, welcome your input and participation in the discussion.

I can be reached at [email protected] or on my cell: 334-412-2487.

And, by the way, I am now taking listings for properties for sale in Alabama and Georgia, so please give me a call, if I can help you.

Finally, I also handle timber sales, buy standing timber and help people evaluate their options on timber sales. So call or write if I can help with any of your timber sales needs.